Many people listen in to Steve’s regular Q&A’s on 4HI every Thursday morning at 6.35am. For those that do, they will know that Steve’s prediction about the average house price in Brisbane soon being $670,000 was correct. As has been stated recently on the news, median house prices are now $673,000.

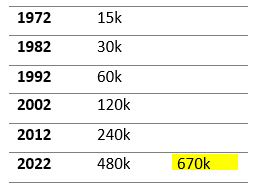

In 1972 the average Brisbane house price was $15,000!

It is quite a jump from $15,000 to $670,000. A concept that is hard to envisage when we think what the future may hold. Who would have thought that in 46 years the price would increase by 45 times! If one worked on the average house price in Brisbane doubling every 10 years, it would prove to be conservative. If you start off with $15,000 in 1972 & double it every 10yrs it would be only $480,000 by 2022, but it is already $673k by 2018.

Conditions in 1972

The average wage of 1972 was $60 p/w, and rent was approximately $20p/w.

Inflation in real terms

In real terms, it is not so much the value of the house doubling, but the purchasing value of your dollar halving. I.e. while what we buy might double in value, the amount borrowed does not. At Steve Taylor & Partners, we take advantage of the laws of inflation and make them work for our investors. We do this by using solid bricks & mortar. Real estate cannot…

Read more articles like this?

Visit our Inflation Category in our blog.

Download your Free Residential Investment Checklist.

…be lost or stolen. It produces equity through which one can purchase more of the same.

Cash in the bank

For retirees with cash in the bank, inflation is their worst enemy. If you retired today with $1m in the bank, it is likely that in 10yrs your purchasing power could be halved, whereas, the dollar value of a quality home in Brisbane might well double.

Has this happened to you or someone you know?

A couple came up to Emerald about 20 years ago from Melbourne. They entered the mining industry with a 5yr plan to set themselves up for life. They both had good jobs, did not drink, did not smoke & saved every dollar they could. They owned a nice little home in Melbourne outright. They did not want to rent out the home in Melbourne, so they sold it & put the proceeds in the Bank. In 5yrs they added to the proceeds with all their savings and returned to Melbourne. Sadly, with the proceeds of selling the house & all their savings for 5yrs, they just had enough to buy a house similar to the one they sold 5yrs before.

A powerful lesson to learn

Don’t let this happen to you. To protect your capital & income in retirement from inflation, do not buy & sell, but buy & accumulate (with the aim of owning several houses & no debt on retirement.) And remember it is often far better to pay rent where you work, buy an investment property, and rent it out where the growth potential is assured.

A surrogate retirement home

Should you buy only one residential investment home and be debt free on retirement, it does not matter what the cost of a home might then be, as, if you want to sell your investment home to buy elsewhere, you are buying & selling in the same market. I.e. If by the time you retire, the average price of a home is $2m, the sale of one counters the purchase of another.

Need help to start your residential property investment portfolio or simply want to learn more? Schedule a free, no-obligation consultation and let’s discuss your options.

If you prefer to listen here is my radio interview on Emerald 4HI:

At the helm of Steve Taylor & Partners, Steve has been delivering expert advice and product knowledge to clients for over 30 years. We provide individuals, couples and families with the right strategies to create wealth and change their lives with solid bricks and mortar.

At the helm of Steve Taylor & Partners, Steve has been delivering expert advice and product knowledge to clients for over 30 years. We provide individuals, couples and families with the right strategies to create wealth and change their lives with solid bricks and mortar.

DISCLAIMER

All information presented on this website https://stevetaylor.com.au has been provided as general advice only and should not substitute the obtainment of independent professional advice given in consideration of your personal financial circumstances, needs or objectives. While Steve Taylor & Partners Pty Ltd intends to only present up to date and accurate material and information through its website, we accept no liability for loss or damage (including indirect, special or consequential loss or damage to any person) with respect to decisions or actions taken in reliance of such information. We recommend users to exercise their own skill and care. Further, Steve Taylor & Partners Pty Ltd takes no responsibility as to the accuracy of information on third party links made available through our website but are merely provided for the users’ convenience.

Fill and Submit this form for your Free Residential Investment Checklist.

If a house in 20yrs time is $2m - How can we afford that??!! -

[…] average price of a house in Brisbane was $15k. Who would have thought now the average price is $673k. What’s more, if it costs $2m in twenty years’ time, will we be able to afford it? The […]