Investing in Property through a SMSF

We attended the Westech Field Days at Barcaldine on September 12th and 13th. Whilst we had a lot of enquiry at Westech about investing in Brisbane through my traditional residential investment packages we also had a lot of interest in setting up self managed super funds (SMSF) and building up an off-farm investment portfolio.

We shared our booth with my colleague Peter from Peter Maundrell & Company; we also share an office in Emerald.

We shared our booth with my colleague Peter from Peter Maundrell & Company; we also share an office in Emerald.

I work closely with Peter in setting up SMSF for our mutual clients, let me explain the process.

I provide the investment property in Brisbane’s northern corridor and Peter handles the setting up of the SMSF and a full review of the client’s financial health.

Peter can you explain your role and the benefits to your mutual clients?

Peter: I am a Chartered Accountant, Registered Tax agent and importantly a Certified Financial Planner.

Why is it important that you are a Certified Financial Planner?

Peter: Prior to June 2016, anyone could set up a self managed super fund. Since then you need to have a license to set up super funds. As my company, CQ Finance Services Pty Ltd, is an Authorised representative with Politis Investment Strategies, I am able to not only set up self managed super funds but do a complete Financial Plan in the process.

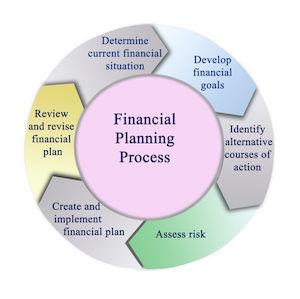

What do you mean by complete financial plan?

Peter: We are able to do a complete financial plan for the investor looking at all aspects of their financial health including wills, insurance, budgets, appetite for risk and more importantly investments.

That sounds complex?

Peter: It never ceases to surprise me that people who are successful in either their career or business do not take the time to sit down and consider their goals in life. Unless you have a plan it is not possible to plan your future, retirement or investments.

Since the early 1990’s, I have had mutual clients with Steve Taylor and they have been satisfied with investing in property in Brisbane.

With the opportunity to use a SMSF, it is possible to use superannuation funds to invest in a property with a further bank loan. The debt can be paid down by the rent received, less expenses on that property and annual super contributions made to their super fund.

What does this mean to the average investor?

Peter: It means generally that with rent and maximum super contributions, the bank loan can be paid off a lot quicker than a normal loan. You also are in control of your property and superfund investments. Obviously, this is general advice and that is why we do a tailored Financial Plan. So you can see that it is quite a comprehensive service that Steve and I provide for SMSF clients.

Peter: It means generally that with rent and maximum super contributions, the bank loan can be paid off a lot quicker than a normal loan. You also are in control of your property and superfund investments. Obviously, this is general advice and that is why we do a tailored Financial Plan. So you can see that it is quite a comprehensive service that Steve and I provide for SMSF clients.

Steve – There is no cost or obligation to see me and if buying in a traditional manner no loan application or valuation fees. If they wish to proceed with setting up a SMSF, they pay Peter a modest upfront fee that is refunded from the SMSF.

How do you put the deal together?

Steve – A SMSF can only buy a completed house. Traditionally this means the builder buying the land and paying stamp duty, and then stamp duty is paid again on the house and land. To save money for our clients we have them buy the house and land direct from the developer avoiding double stamp duty.

Read more articles like this?

Visit our Property Investment and Superannuation Category on our blog.

Download your Free Residential Investment Checklist.

Sample figures on one of our typical SMSF properties

Let’s take a 5-bed executive home built to full cyclone rating with permanent termite treatment for a client earning $100k per annum and $220k in Super. With 30 years term Principal & Interest loan, Price $527,400. Net contribution $NIL, in other words the minimum employer contribution of 9.5% is sufficient to pay all outgoings like rates insurance maintenance and still pay the loan off principal and interest.

It doesn’t get much better than that. Many thanks, Peter for participating. I am sure our listeners/readers found this all very informative.

Until next week …

Steve Taylor

Need help investing in property in Brisbane the right way? Please contact our office to schedule a free, no-obligation consultation and let’s discuss your options.

If you prefer to listen here is my radio interview on Emerald 4HI:

At the helm of Steve Taylor & Partners, Steve has been delivering expert advice and product knowledge to clients for over 30 years. We provide individuals, couples and families with the right strategies to create wealth and change their lives with solid bricks and mortar.

At the helm of Steve Taylor & Partners, Steve has been delivering expert advice and product knowledge to clients for over 30 years. We provide individuals, couples and families with the right strategies to create wealth and change their lives with solid bricks and mortar.

DISCLAIMER

Steve Taylor & Partners blog is opinion and not advice. Readers should seek their own professional advice on the above subject. The figures stated in this article were accurate at the time of publication. For up to date figures, please contact our office.

Fill and Submit this form for your Free Residential Checklist.